Day Trade Market Condition

Day Trade Market Condition, update daily on Tradingview community trade idea.

Jesse Livemore "There is only one side to stock market; and it is not the bull side or the bear side, but the right side":

NQ, ES, CL , BTC (a day trader on NQ, markets I pay attention with);

The following systematically generates levels throughout the day in a slightly unconventional format.

The purpose of these levels is to avoid OVERTRADING and to TRADE with the TREND. The programming behind the levels is Volume Profile.

How to use these levels? Focus on two trends: the Primary for swing and Short term (for Day Traders) shown in a table.

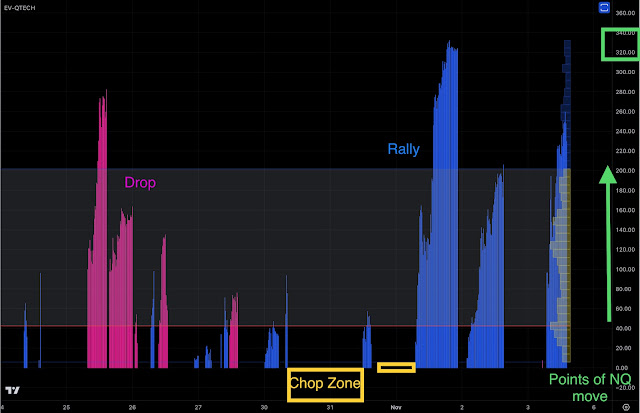

- Short term "Rally" favors LONG, while "Drop" favors short. In between is the "SHOP zone" where prices can travel between supply and demand levels set by market makers.

- Primary trend is for swing trading on a higher time frame. When it's a "BULL" trend, the days are up, and when it's a "BEAR" trend, the days are down. The numbers displayed indicate the trades accumulating on the higher time frame.

I conducted a statistical analysis on the blue histogram representing "Rally" and the magenta histogram representing "Drop" to see how far the price moved from such levels.

- Rally, long position offers higher success

- SHOPzone, price fluctuate randomly between Supply/Demand levels (traders get burden mostly, day trading)

- Drop, short position offers higher success

- BULL, up trend for the week

- Cumulating , keep eyes on left column (the first top 3 above)

- BEAR, down trend for the week

Comments

Post a Comment