Apply Volume Profile

Apply Volume Profile in a simplified way

Dynamic Volume Profile is a versatile tool for TradingView that provide traders with valuable insights into market activity.

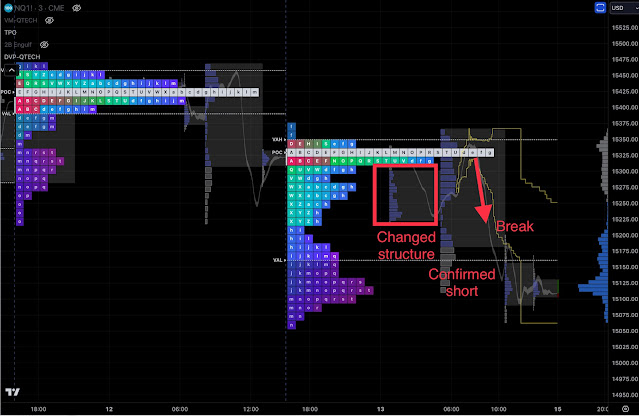

1. **Automatic Calculation**: Dynamic Volume Profiles generated a series of profile for each cycle of market participants. By comparing the profile at a particular point on the chart, traders can analyze volume distribution within that defined region, providing insights into market activity at that specific level.

2. **Identification of Key Levels**: They help identify key support and resistance levels. Traders can spot areas where significant volumes were traded, signifying areas where the market has shown interest. These levels can act as strong support or resistance.

3. **Validation of Breakouts**: Dynamic Volume Profiles can validate the strength of price breakouts. When a price breaks through a region with high volume, it's often seen as a stronger breakout compared to one with low volume. This provides confidence to traders regarding the authenticity of the breakout.

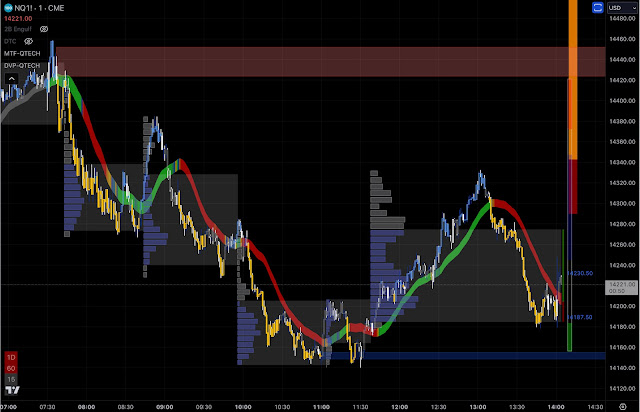

4. **Contextual Information**: By anchoring the profile to a relevant point, traders can gain contextual information about price movement. For example, they can analyze how volume and trading activity have evolved relative to a significant event or news release.

5. **Decision-Making Tool**: Dynamic Volume Profiles are an essential tool for decision-making. They help traders understand where institutional or retail traders are active, allowing them to align their strategies accordingly. This can improve trade entries, exits, and risk management.

6. **Intraday Insights**: When using intraday charts, Dynamic volume profiles can provide insights into micro-level price action by displaying the VALUE how market participants react. Traders can identify areas where significant Profile are being transacted during the trading day.

7. **Risk Assessment**: They help traders assess risk. Knowing where substantial volumes are concentrated can be critical for understanding potential market reversals and areas where stop-loss orders may be triggered.

8. ** Confirming Trends**: By analyzing volume profiles, traders can confirm the strength or weakness of a trend. For example, a strong uptrend with high volume at key price levels indicates conviction among buyers.

9. **Forecasting**: These profiles can aid in forecasting potential price movements. By understanding where significant trading activity has occurred in the past profile, traders can anticipate areas where price may face resistance or support.

10. **Education**: Dynamic Volume Profiles are an excellent educational tool. Traders, especially those new to technical analysis, can use them to gain a deeper understanding of how volume impacts price levels and influences trading decisions.

In summary, Dynamic Volume Profiles help in decision-making, risk management, and understanding price behavior, making them a critical component of technical analysis for many traders.

Comments

Post a Comment